Buying a home with a bankruptcy, foreclosure or short sale in your past credit history. By Jason Sumner Sr. Loan Officer, Ruoff Home Mortgage

Have you had a derogatory credit event in your past such as bankruptcy, foreclosure or short sale? Whether due to a medical reason, a loss of a job or from a myriad of other reasons, many people have experienced this. The good news is that with some careful planning and knowing your options, you can likely can still buy a home. Of course, there are certain guidelines you need to meet depending upon which program you want to qualify for. One of the most liberal in terms of length of time since a Chapter 7 bankruptcy is FHA. With two years elapsed from the date of your bankruptcy discharge and with clean re-established credit history, you can buy a new home with only 3.5% down through the FHA program. The mandatory 3.5% down can even be a gift from a relative. For a Chapter 13 bankruptcy (monthly payback bankruptcy), FHA will even allow for the purchase of a home when you are within the payback period so long as one year has elapsed from the start of the payments and so long as they’ve been on time. With its low interest rates and recently reduced mortgage insurance rates, FHA is an excellent choice for many buyers.

Another good option would be a Conventional mortgage which is less lenient on the discharge time frame (generally 4 years from the discharge date of the Chapter 7 unless there were extenuating circumstances) or two years from the discharge of a Chapter 13. A Conventional mortgage can result in a slightly overall lower monthly payment if your credit scores have rebounded to a high enough level. If your scores have not rebounded sufficiently enough then you should consider either an FHA, USDA Rural Housing or a VA (Veterans) loan. VA’s timeline for a Chapter 7 is generally 2 years from the discharge date and Rural Housing’s is 3 years from the discharge date for a Chapter 7 with more lenient guidelines for Chapter 13’s.

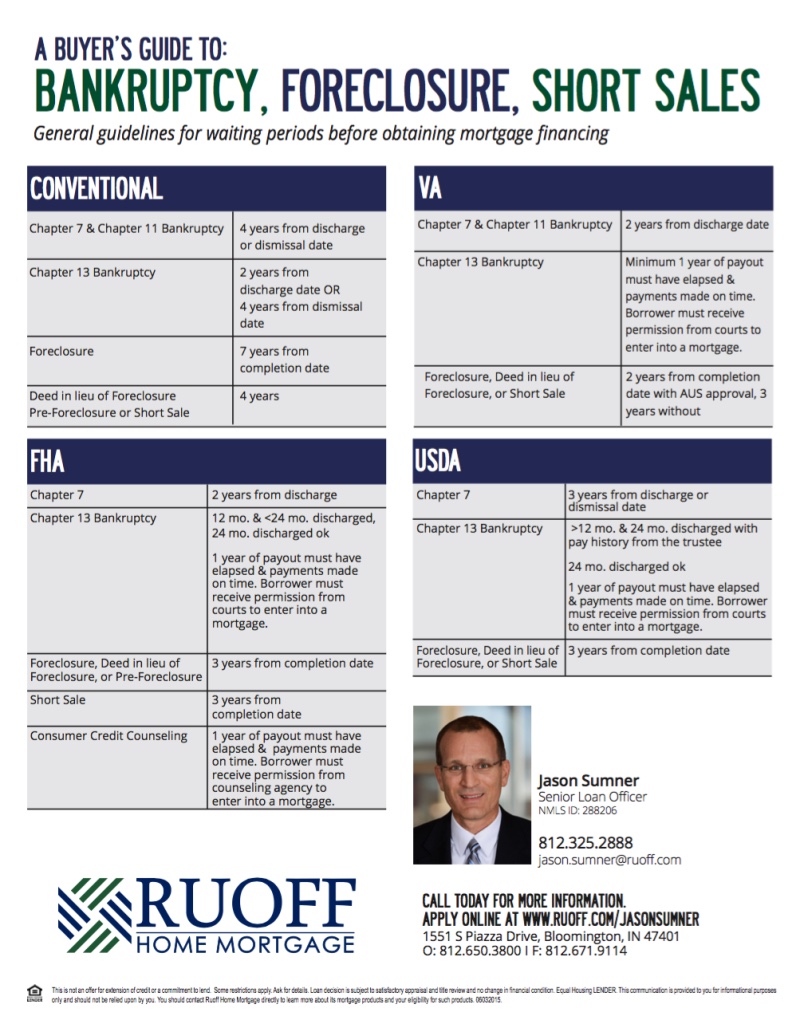

The bottom is line is that regardless of your circumstance, there are many available options and each situation is different. Contact me to discuss your situation and if necessary to see what you can do to improve your credit scores. We even have a credit score simulator which allows us to predict what your future scores would look like if you make certain changes (i.e. paying something off, reducing the size of a debt or even opening a new account). See the attached guideline matrix for bankruptcy discharge, foreclosure and short sale information.

Jason Sumner has 14 years of experience as a Mortgage Loan Officer and nearly 20 years total experience in the financial services field. He specializes in new home purchases including: Conventional, FHA, 100% no money down USDA & VA loans, and down payment assistance programs for first time buyers. He is a graduate of Indiana University and resides in Bloomington with his wife and 3 ½ year old daughter, Lillian.